Few industries have seen such a dramatic increase in innovation like FinTech. Throughout the past decade, there has been an important increase in the number of products and services that have reached the market. Overall, this has been beneficial for users. However, it has also been a challenge for regulators.

Table of Content

As the pace of innovation keeps increasing, and as the FinTech industry consolidates itself as a key player in the world economy, regulators face the challenge of guaranteeing consumers’ rights. This is no easy task. Luckily, innovation has also favored regulation.

As new FinTech apps enter the market, regulators have developed creative ways to test their impact before going full scale. Evaluating the impact of an app on a small scale can help determine its effects and subsequently develop the necessary regulatory frameworks to protect consumers. In this post, we discuss what is a FinTech sandbox and why it matters for regulators, app developers, and consumers.

The Regulatory Challenge: Keeping up With Innovation

One would normally think that the challenge with innovation is to fuel it. However, in a world where technology is moving pretty fast and everyone wants to be the first to deliver new products and services to the market, we suddenly find ourselves flooded in innovation. Startups and enterprises are betting hard on delivering new ideas.

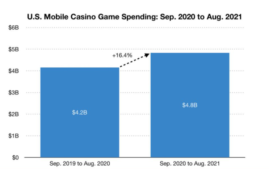

Companies have adopted innovation as their mantra. This is particularly true in the FinTech industry. FinTech spending was around $19 million in 2013. By the first half of 2019, this number had grown to $120 billion. As of 2020, even with the pandemic, it is now clear that this pace will not be heavily impacted. It might even be possible that in the years to come we will see an increase in investments as more processes become digitalized.

This poses a great challenge for FinTech regulators. Financial regulation exists for various reasons, being one of the most important ones protecting consumers. By setting frameworks that clearly establish the goals and responsibilities that companies should keep an eye on, regulators can make sure that the market takes care of consumers.

Since the pace of innovation and the number of FinTech apps have increased dramatically in recent years, it has become hard for financial regulators to keep up. Not only is it necessary to update what already exists. It has also become necessary to develop new frameworks from scratch for products that didn’t exist just a couple of years ago. An example of a regulatory requirement is the existing PCI compliance measures that regulate FinTech companies’ transactions. An app development partner that has experience with FinTech compliance matters is a valuable asset for companies.

This situation is not expected to change anytime soon. On the contrary, innovations are expected to grow. Because it would be unfair to slow down the rate at which new products and services are introduced in the market due to this regulatory bottleneck, some solutions have been developed. One, in particular, stands out.

The Solution: A FinTech Regulatory Sandbox

A sandbox is a closed testing environment in which a software innovation is tested before being fully deployed in the market. The test involves a reduced number of participants and their interactions, thus emulating real market conditions. This allows regulators to analyze the potential impacts of a product or service in order to develop a framework that protects consumers. It takes its name from the children’s play arena as it allows regulators to keep an eye on a small sample of agents involved.

One of the best things about this tool is that it helps find a balance between innovative business models and regulators’ understanding of how markets will behave. As a result, the pace of innovation is not affected and the results help reduce risks. This translates into better products and services, reduced costs, and improved access to finance.

A FinTech regulatory sandbox plays an important role in improving apps. By using one, app developers can better understand how consumers behave. This allows them to make changes in case it is necessary. This might cause some delays in terms of an app’s time-to-market, but in the long run, it saves important resources by avoiding systemic risks. It is also worth considering that this strategy is better than waiting for regulators to understand fully the potential risks and impacts of an app without any actual empirical data.

Implementation

A great FinTech regulatory framework requires performing the appropriate tests. These will guarantee that different variables and scenarios are considered.

There are various criteria to decide when and how to implement these sandbox tests. In general, successful implementation depends on three key elements:

- Understanding the nature of the innovation. By doing so, regulators are able to determine the degree to which the new product or service can disrupt the existing market and how it will affect consumers.

- Continuous communication between the regulator and the company involved. Setting clear communication channels, expectations and goals can help validate premises and monitor key metrics.

- Determine key questions to answer. Determining beforehand which unknowns are important to investigate can help reduce uncertainty while focusing on what matters.

There is no formula for testing every possible FinTech innovation. Nonetheless, by focusing on these elements, companies and regulators can be sure that they are on the right track. Aside from taking these matters into account, it is also important to work with someone with the right experience in developing FinTech apps.

FinTech Apps

Many FinTech companies fail not because they have a bad idea, but rather because they are unable to deliver a world-class app. With so many ideas reaching the market, competition is becoming stronger. Only the companies with the best apps will be able to survive.

It is important to have the right people in your team. Even more important is to have the right app development partner. Experience is not something that can be improvised when it comes to building a great app. It is necessary to understand a wide range of issues spanning from the business model to the technical aspects of the software being used.